How Much Is Bonus Depreciation In 2024 Calendar

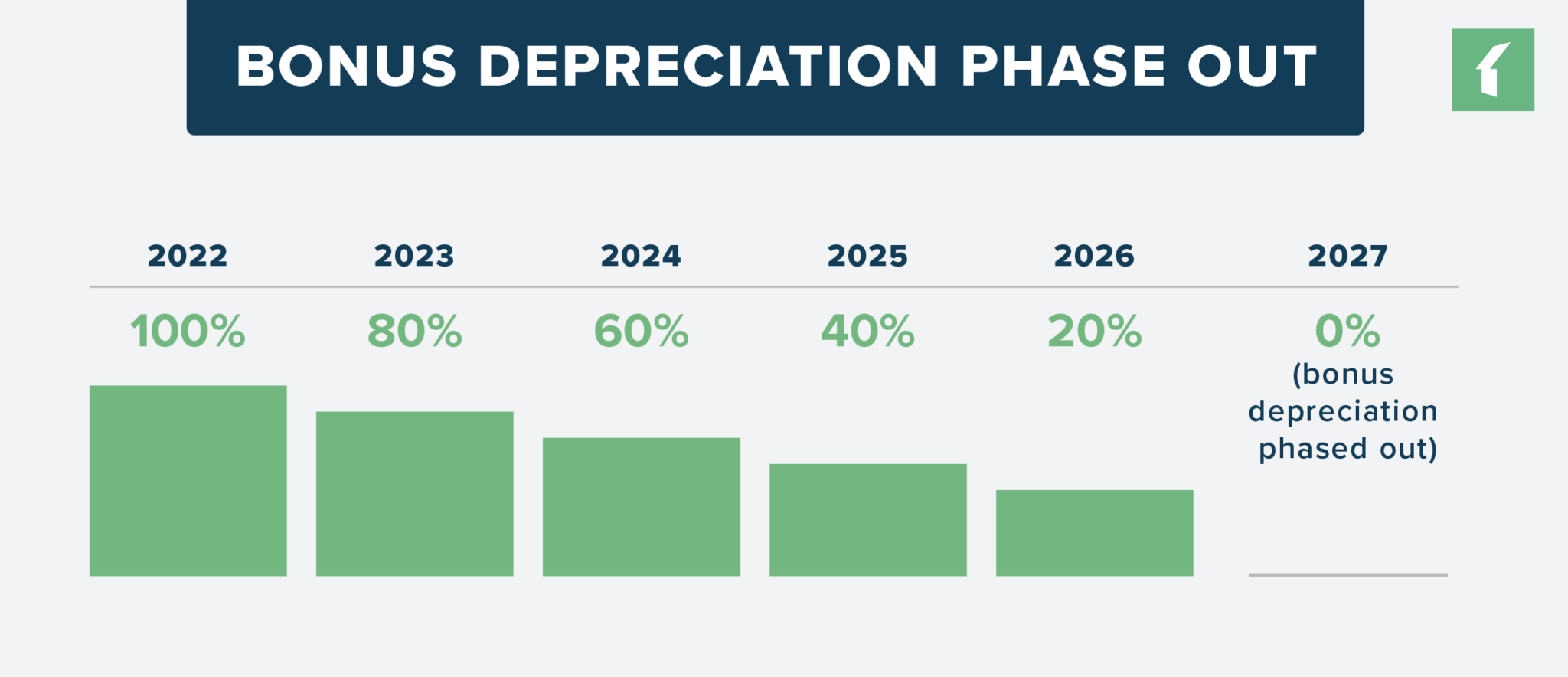

How Much Is Bonus Depreciation In 2024 Calendar. What are the eligibility requirements for the additional first year depreciation deduction following the enactment of the tax cuts and jobs act of 2017 (“tcja”)? Bonus depreciation allows businesses to deduct a large percentage of the cost of eligible purchases in the year when they acquire them, rather than depreciating them evenly over a period of.

Utilize both bonus depreciation and section 179 expensing to maximize tax savings. How is bonus depreciation set to change in 2024?

How Much Is Bonus Depreciation In 2024 Calendar Images References :

Source: cathyleenwchanna.pages.dev

Source: cathyleenwchanna.pages.dev

2024 Vehicle Bonus Depreciation Debi Mollie, Bonus depreciation is a way to accelerate depreciation.

Source: gaelbalfreda.pages.dev

Source: gaelbalfreda.pages.dev

2024 Bonus Depreciation Rates Dannie Kristin, This guide to bonus depreciation will explain this method, what.

Source: alfiqhermina.pages.dev

Source: alfiqhermina.pages.dev

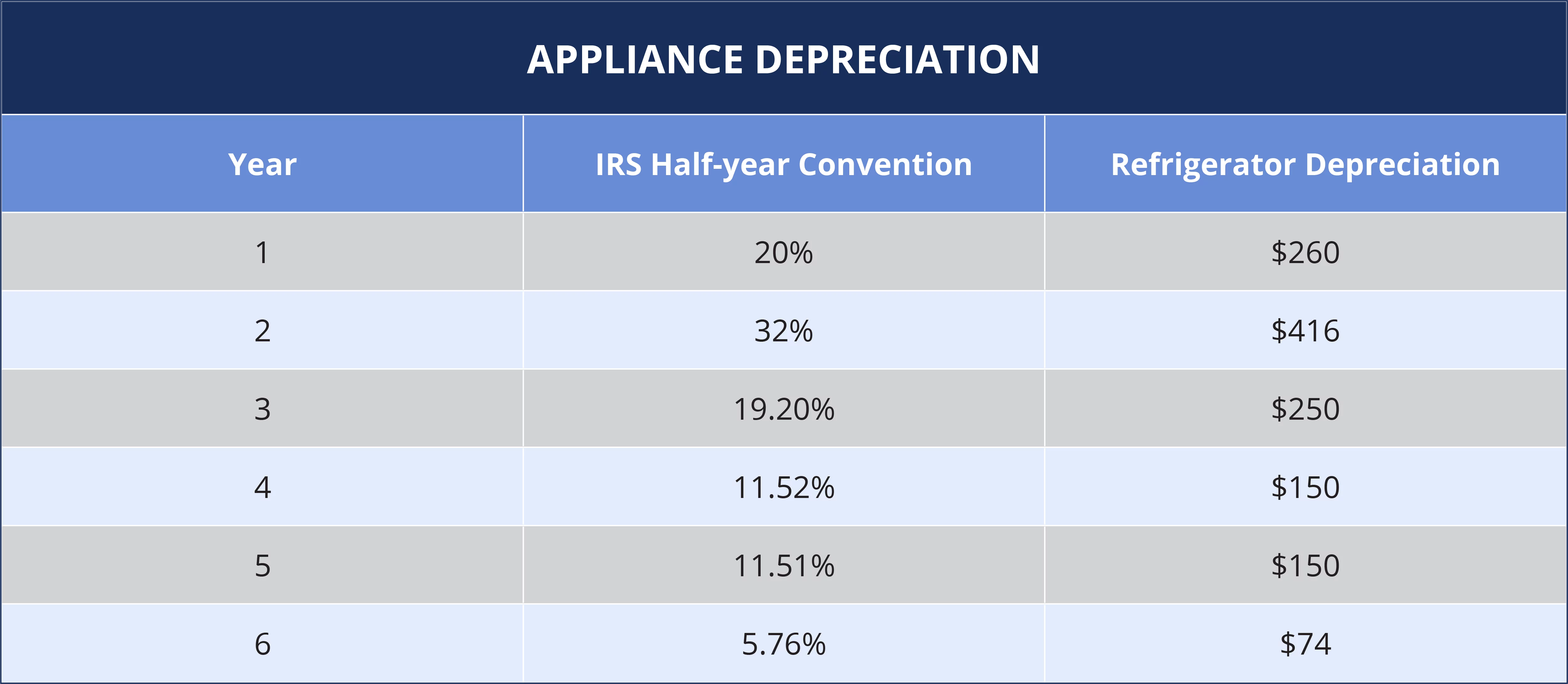

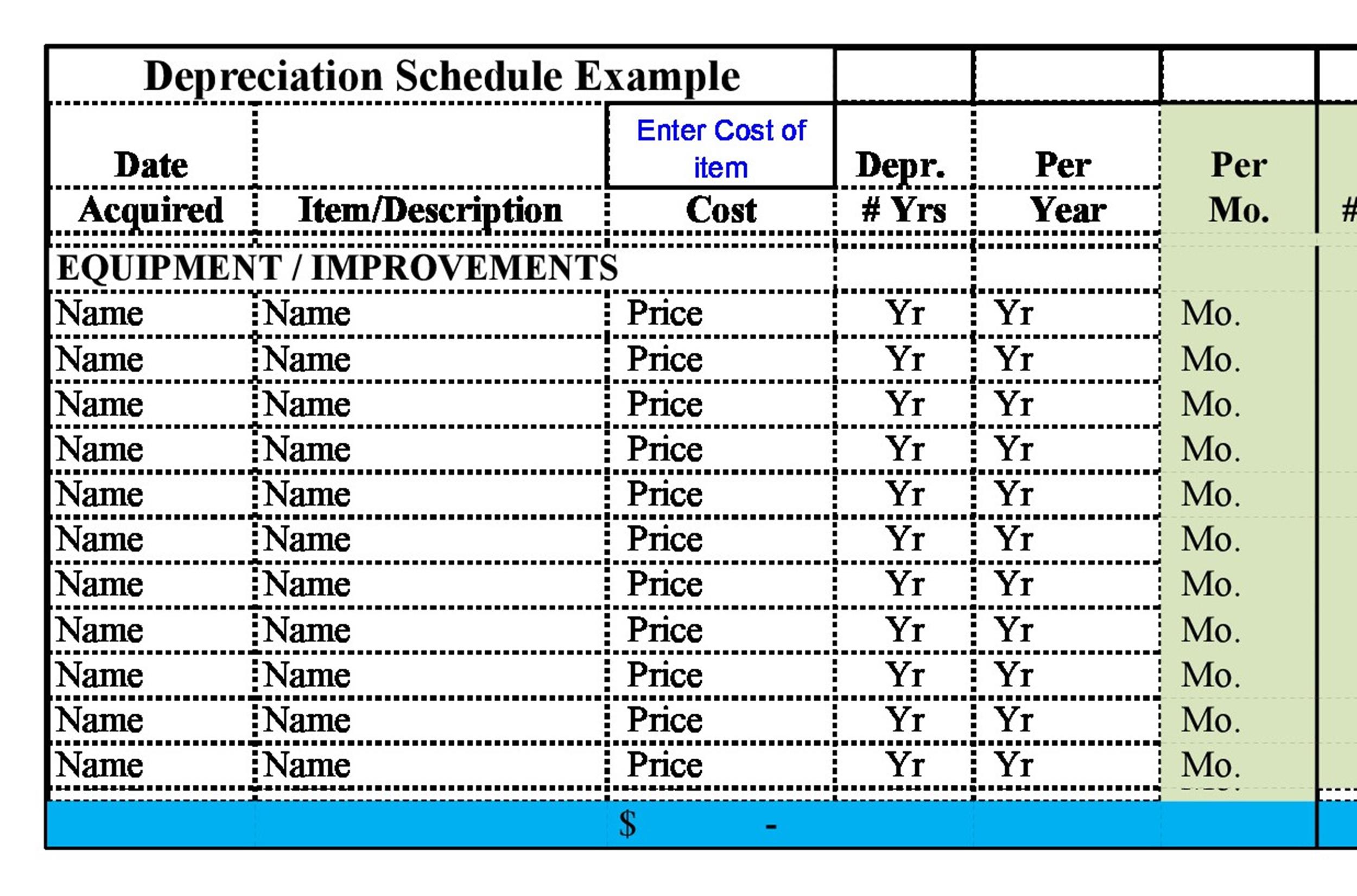

Bonus Depreciation Calculator 2024 Nola Terrye, The remaining $4,000 will be depreciated in future years according to.

Source: sailsojourn.com

Source: sailsojourn.com

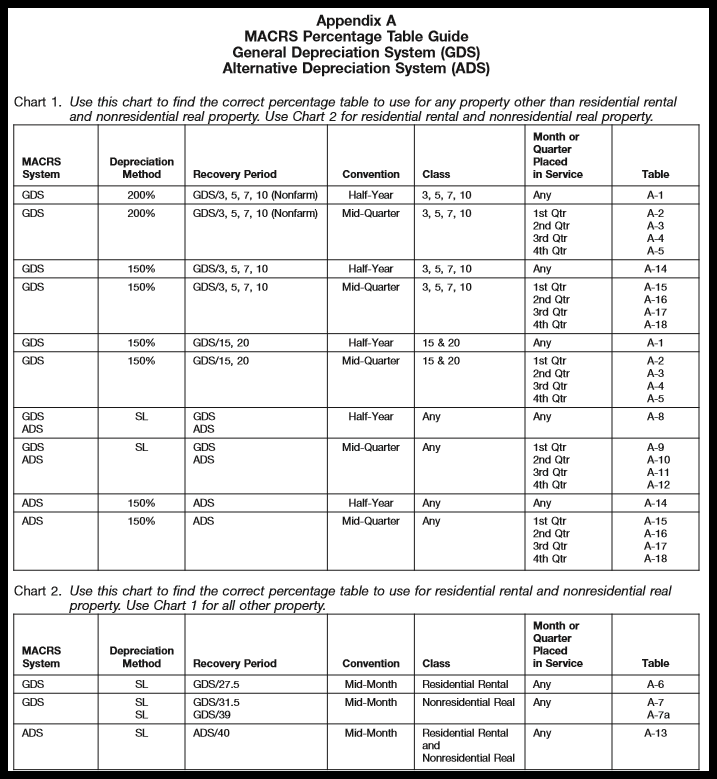

8 ways to calculate depreciation in Excel (2024), Bonus depreciation allows qualifying businesses that spend more than the 2024 section 179 limit to depreciate up to 60% on the remaining purchase amount.

Source: aureliawsilva.pages.dev

Source: aureliawsilva.pages.dev

2024 Bonus Depreciation Percentage Table Debbie Kendra, For vehicles under 6,000 pounds in the tax year 2023, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of.

Source: traciqstephi.pages.dev

Source: traciqstephi.pages.dev

Bonus Depreciation 2024 15 Year Property Astrid Eulalie, It allows businesses to deduct a significant portion of a purchased asset’s cost in the year.

Source: gaelbalfreda.pages.dev

Source: gaelbalfreda.pages.dev

2024 Bonus Depreciation Rates Dannie Kristin, In 2024, the bonus depreciation rate will drop to.

Source: sissyqmadonna.pages.dev

Source: sissyqmadonna.pages.dev

Tax Depreciation For 2024 leola myranda, If we’re in 2024, you can depreciate $6,000 ($10,000 purchase x 0.6 bonus depreciation rate).

Source: adianabjoeann.pages.dev

Source: adianabjoeann.pages.dev

Business Car Depreciation 2024 Koral Cassandra, Bonus depreciation is a way to accelerate depreciation.

Source: templates.rjuuc.edu.np

Source: templates.rjuuc.edu.np

Depreciation Schedule Excel Template, It allows a business to write off more of the cost of an asset in the year the company starts using it.

Posted in 2024